Why This Matters in Dallas–Fort Worth

If you run a money transfer business in DFW, your security obligations aren’t optional. Texas MSB licensing, FinCEN registration, and PCI DSS compliance all demand that you prove your systems are hardened against fraud and cyber threats.

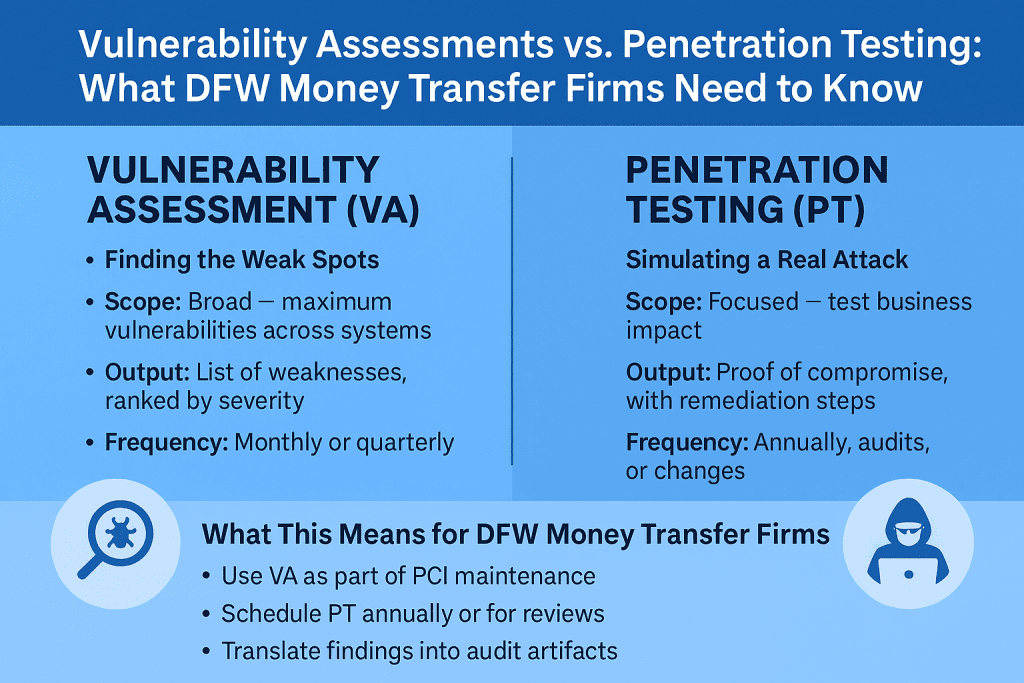

Yet we often hear the same question from compliance officers: “Do we need a vulnerability assessment, or a penetration test?” The truth is, both play a role — but they serve very different purposes.

Here’s how to decide which makes sense for your next audit, partner review, or internal security upgrade.

Vulnerability Assessment (VA): Finding the Weak Spots

Think of a vulnerability assessment like a health check for your IT systems. Automated tools (and some manual review) scan your infrastructure, applications, and configurations to flag known flaws.

- Scope: Broad — maximum vulnerabilities across systems

- Output: A list of weaknesses, ranked by severity (CVSS scores, likelihood × impact)

- Frequency: Monthly or quarterly (especially after tech updates)

📌 DFW Example: A Plano-based transfer firm recently used VA to uncover outdated software in teller PCs. The fix was simple but critical — if left unchecked, it could have opened the door to fraud.

Penetration Testing (PT): Simulating a Real Attack

A penetration test goes beyond finding vulnerabilities — it exploits them to see what an attacker could really do. Pentesters use both tools and human creativity to chain flaws together, simulating how a criminal might breach your defenses.

- Scope: Focused — test business impact through real-world exploitation

- Output: Proof of compromise, with remediation steps tied to compliance requirements

- Frequency: Annually, or before audits, new systems, or bank partner reviews

📌 DFW Example: A Fort Worth money transmitter learned during a pentest that weak teller logins could be chained with a phishing campaign to access their transaction database. Fixing this not only improved security but also reassured their partner bank.

How They Differ (and Work Together)

- Automation vs. Human Creativity: VA is mostly automated; PT adds a human attacker’s perspective.

- Depth vs. Breadth: VA finds many flaws; PT shows what matters most to your business continuity.

- Timing: VA is ongoing; PT is scheduled around compliance cycles or major changes.

In practice, most DFW firms need both:

- VA to stay ahead of day-to-day vulnerabilities.

- PT to prove to auditors, banks, and regulators that you’re resilient against real-world threats.

What This Means for DFW Money Transfer Firms

Regulators and partners in Dallas–Fort Worth increasingly expect proof that MSBs are serious about security. Here’s how to frame it:

- Use Vulnerability Assessments as part of your ongoing PCI maintenance program.

- Schedule Penetration Tests annually, or when preparing for Texas DoB examinations or bank partner due diligence.

- Translate findings into audit-ready artifacts so compliance officers can present evidence with confidence.

Closing: Your Local Partner for VA + PT

At CyberCile, we specialize in helping DFW money transfer firms close the gap between finding vulnerabilities and proving compliance.

- PCI DSS alignment for card data security

- MSB license support with Texas DoB requirements

- Audit-ready pentest reports for FinCEN and banking partners

If you’re running branches from Dallas to Fort Worth and want a partner who speaks your compliance language, let’s connect.

Schedule Your VA + PT Readiness Review https://calendly.com/cybercile/15min