Why This Matters for MSBs in Dallas–Fort Worth

Money transfer firms in DFW are embracing AI and machine learning — from fraud detection to transaction monitoring. Hosting these models in-house gives you more control over sensitive data and helps satisfy Texas MSB license requirements, PCI DSS obligations, and FinCEN oversight.

But here’s the problem: self-hosted AI pipelines dramatically expand your attack surface. If they’re not secured properly, you could face regulatory fines, fraud exposure, or even loss of banking partnerships.

Common Risks in Self-Hosted Pipelines

1. Unprotected Model Weights

We’ve seen firms store model weights in shared folders or unencrypted drives. That’s like leaving your intellectual property — and months of fraud-prevention R&D — on the sidewalk. Encrypt them, control access, and keep secure backups.

2. Weak Access Controls

Shared logins are still common in MSBs with lean IT teams. Without role-based access controls (RBAC), a teller or junior staffer could have admin rights — and so could an attacker. Enforce RBAC, MFA, and environment segmentation.

3. Insecure Data Storage & Transfer

Your fraud-detection models are only as secure as the customer data they’re trained on. ioSENTRIX often finds plaintext storage or insecure APIs. For DFW firms handling cardholder data, that’s a PCI DSS violation waiting to happen.

4. Poisoned Third-Party Datasets

Training on third-party or vendor-provided datasets without validation is dangerous. Hidden “backdoors” can be baked into your models. Treat datasets like code — scan, validate, and verify sources.

The Cost of Overlooking Security in Development

Most firms rush AI/ML development to stay competitive. But skipping secure coding and data practices creates long-term compliance and fraud risks.

For example, one Irving-based firm rushed an AI fraud model into production. Months later, they discovered a misconfigured API exposing customer data. The remediation and audit fallout cost far more than if they’d built security in from day one.

Best Practice: Run dependency checks, keep libraries updated, and monitor open-source frameworks like TensorFlow and PyTorch for vulnerabilities.

What This Means for DFW Money Transfer Firms

For MSBs in Dallas–Fort Worth, self-hosted AI/ML pipelines are powerful — but they must be hardened to protect:

- Licensing stability (Texas DoB exams)

- Regulatory compliance (PCI DSS, FinCEN)

- Banking partner trust (due diligence reviews)

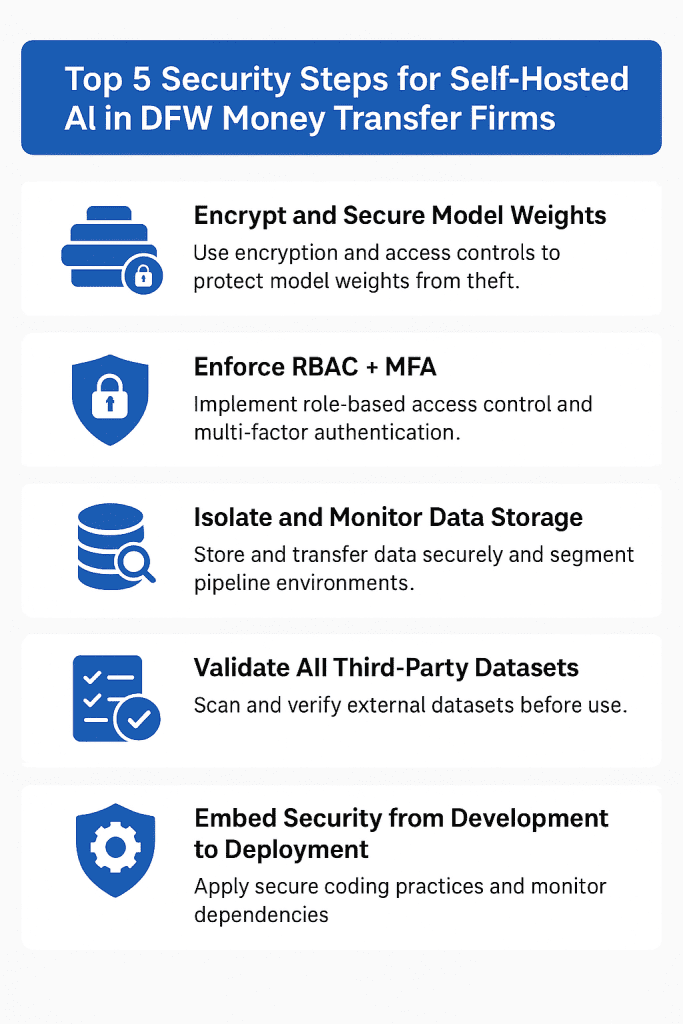

Checklist for DFW MSBs:

- Encrypt and secure model weights

- Enforce RBAC + MFA

- Isolate and monitor data storage

- Validate all third-party datasets

- Embed security from development to deployment

Closing: Build Secure AI the Right Way in DFW

At CyberCile, we help Dallas–Fort Worth money transfer firms secure AI/ML pipelines that power fraud detection and compliance monitoring.

- Harden self-hosted models against theft and misuse

- Map controls directly to PCI DSS and Texas MSB requirements

- Deliver audit-ready reports for regulators and partner banks

👉 If you’re rolling out AI systems in Dallas, Plano, or Fort Worth, don’t risk shortcuts. Let’s secure your models before regulators or attackers find the gaps.

📞 Request an AI/ML Security Assessment https://calendly.com/cybercile/15min