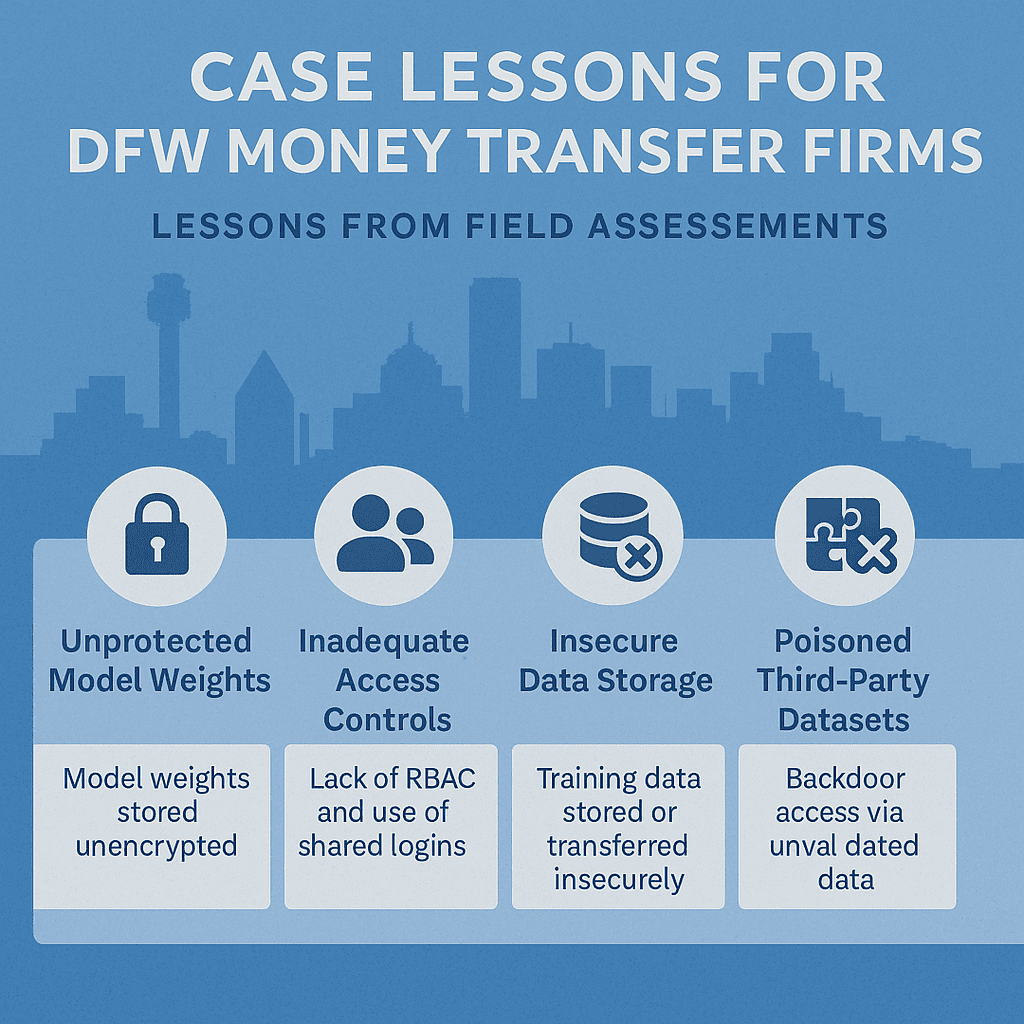

At CyberCile, we’ve assessed AI/ML deployments across financial services — including firms right here in Dallas–Fort Worth. Too often, money transmitters adopt AI for fraud detection or compliance monitoring but overlook basic security. Here are real-world lessons that apply directly to MSBs in our region:

🔐 Unprotected Model Weights = Lost IP and Compliance Risk

In one DFW case, model weights were stored in a shared drive with no encryption. Anyone with access — or a compromised teller workstation — could have stolen years of fraud-prevention R&D. For MSBs, that’s not just IP theft; it’s a PCI DSS violation and a risk to licensing.

Lesson: Encrypt model weights, enforce strict access controls, and keep secure backups.

👥 Inadequate Access Controls = Insider Exposure

We’ve seen money transmitters still rely on shared logins for AI tools. Without RBAC or MFA, even a junior employee could gain admin privileges. Worse, an insider with malicious intent could misuse sensitive customer data.

Lesson: Enforce RBAC + MFA, segment environments, and log all access.

💾 Insecure Data Storage = Regulator Trouble

In a North Texas engagement, training datasets containing customer PII were being transferred in plaintext. This was a direct PCI DSS violation and would have triggered issues in a Texas Department of Banking exam.

Lesson: Encrypt all storage and transfers, isolate data environments, and actively monitor access logs.

🧩 Poisoned Third-Party Datasets = Backdoor Risks

One Dallas firm fine-tuned fraud models on external vendor datasets without validation. The risk? Backdoored training data that could let fraud bypass detection.

Lesson: Treat datasets like code — scan, verify, and model threats before ingestion.

⚙️ Rushed Development = Long-Term Cost

An Irving-based MSB rolled out an AI fraud model quickly to satisfy a partner bank. But missing dependency checks in TensorFlow left exploitable vulnerabilities. The remediation and compliance fallout cost more than a secure build would have.

Lesson: Bake security into development — run dependency scans, patch libraries, and track open-source vulnerabilities.

Closing Takeaway for DFW MSBs

Self-hosted AI gives money transfer firms more control — but only if it’s done securely. These field lessons show that without encryption, RBAC, dataset validation, and secure development practices, MSBs risk fines, reputational damage, and even banking partner loss.

📞 Schedule an AI Security Assessment for Your DFW Firm https://calendly.com/cybercile/15min