Why It Matters in Dallas–Fort Worth

In today’s Metroplex, customers expect fast, mobile-first transfers — but regulators and banks expect those transactions to be secure and compliant. For money transmitters, a secure payment system isn’t just about protecting customer data; it’s about keeping your Texas MSB license, meeting PCI DSS obligations, and maintaining banking relationships.

We’ve seen DFW firms who skipped security controls face delayed audits, partner mistrust, and even fraud losses. Let’s break down what “secure payment system” really means for your business.

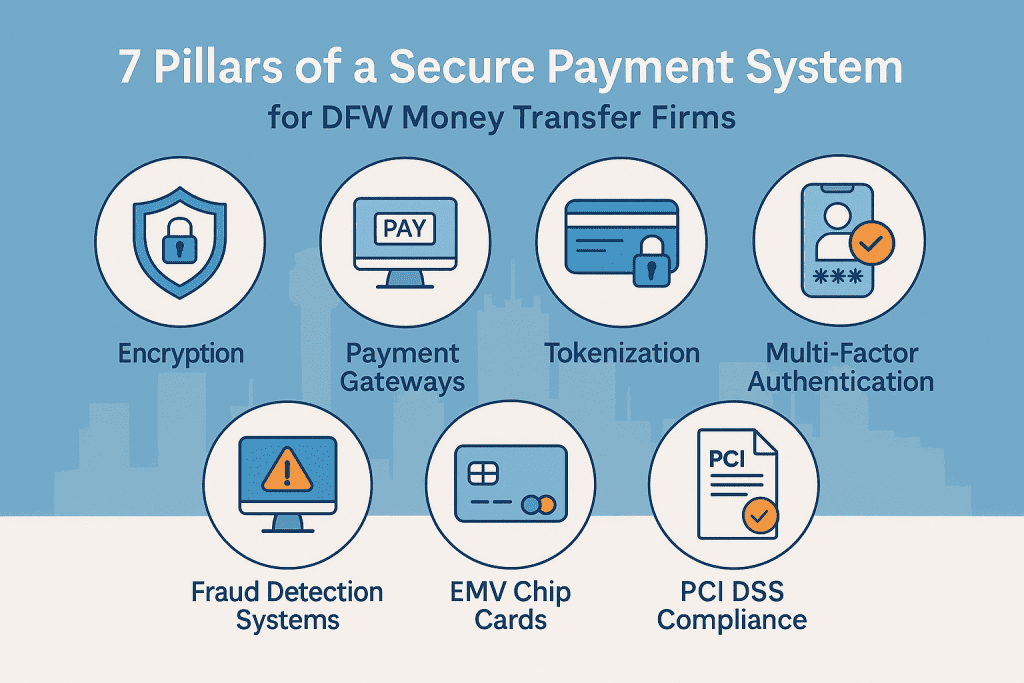

Core Elements of a Secure Payment System

1. Encryption

Transforms sensitive payment data into unreadable code during transfer and storage. Even if intercepted, criminals can’t use it without the decryption key.

📌 DFW Example: A Plano firm encrypted all mobile transfer traffic, preventing fraudsters from harvesting card data on public Wi-Fi.

2. Payment Gateways

Act as the digital POS terminal between your app and the bank. They verify details, check funds, and securely move money — usually in seconds.

📌 Lesson: A Fort Worth transmitter that adopted a PCI-compliant gateway reduced chargeback disputes by 40%.

3. Tokenization

Replaces sensitive cardholder data with unique tokens. Even if intercepted, tokens are meaningless without the secure vault.

📌 Local Relevance: This is critical for PCI DSS compliance in Texas MSBs handling recurring transfers.

4. Multi-Factor Authentication (MFA)

Adds extra layers of identity proof (password + SMS code + biometric). Makes unauthorized account access far more difficult.

📌 Case: An Irving transmitter avoided fraud losses when MFA blocked account takeovers during a phishing wave.

5. Fraud Detection Systems (FDS)

Real-time monitoring powered by machine learning, flagging suspicious behavior (e.g., unusual transfer locations or rapid-fire micro-transactions).

📌 DFW Lesson: A Dallas firm’s FDS caught multiple small transfers from the same card — stopping fraud before regulators asked questions.

6. EMV Chip Cards

The gold standard for in-person transactions, protecting against skimming and counterfeit fraud. Still relevant for DFW firms with teller locations.

7. PCI DSS Compliance

Every secure system must be aligned with PCI DSS standards. Skipping this risks fines, audit failures, and partner banks walking away.

What This Means for DFW Money Transfer Firms

For MSBs in Dallas–Fort Worth, a secure payment system is more than technology — it’s your foundation for trust, compliance, and growth. Without it, you risk:

- Regulatory fines from PCI DSS or Texas DoB

- Partner banks downgrading or cutting ties

- Customer churn from fraud or breaches

Closing: Build Secure Payments with Local Expertise

At CyberCile, we help DFW money transfer firms:

- Encrypt and tokenize transactions

- Implement PCI DSS–aligned gateways and MFA

- Deploy fraud detection tuned for MSB risk profiles

- Deliver audit-ready reports for Texas DoB and partner banks

👉 If you’re processing payments in Dallas, Plano, or Fort Worth, let’s ensure your payment systems are secure, compliant, and trusted.

📞 Schedule Your Payment Security Assessment https://calendly.com/cybercile/15min