Why This Hits Home in Dallas–Fort Worth

For money transmitters in DFW, cutting corners on cybersecurity isn’t just risky — it can be business-ending. Regulators, auditors, and banking partners expect proof that your systems are resilient. A “check-the-box” pentest from a bargain provider won’t cut it when your Texas MSB license or banking relationship is on the line.

We’ve seen it: firms who thought they’d saved money on testing only to lose far more in fines, partner scrutiny, and remediation.

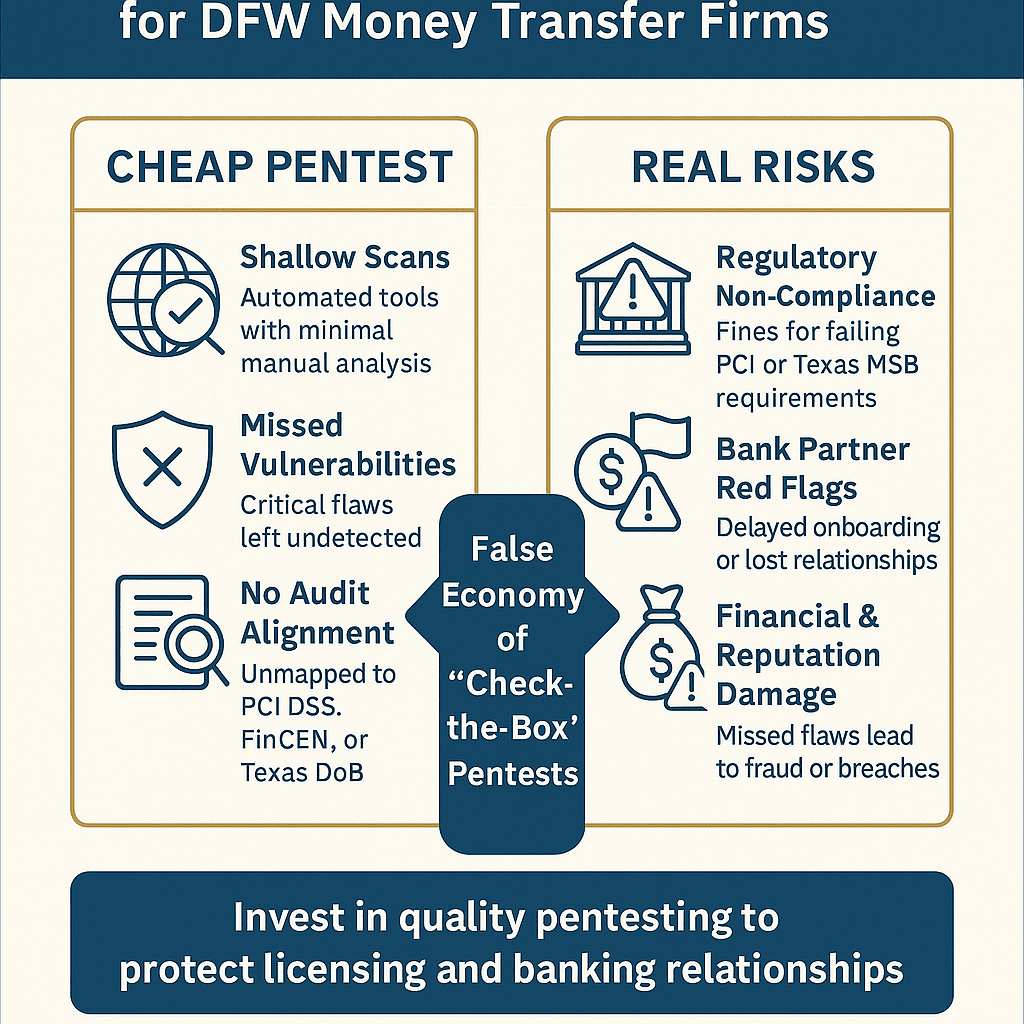

The False Economy of Cheap Pentests

At first glance, a low-cost pentest looks attractive — quick, automated, and budget-friendly. But here’s the reality:

- Shallow Scans: Cheap providers rely on basic tools with little manual analysis.

- Missed Vulnerabilities: Critical flaws go undetected, giving you a false sense of security.

- No Audit Alignment: Reports often don’t map to PCI DSS, FinCEN, or Texas DoB examiner requirements.

📌 DFW Example: A Plano MSB bought a “budget pentest” before a partner bank review. The report looked official but lacked PCI alignment. When the bank pressed for details, the firm couldn’t prove compliance — delaying onboarding and eroding trust.

The Real Risks of Inadequate Testing

Cheap pentests don’t just waste money — they expose you to bigger risks:

- Regulatory Non-Compliance: PCI DSS, Texas DoB, and FinCEN expect thorough testing. Miss a requirement and you risk fines.

- Bank Partner Red Flags: A weak pentest report can jeopardize existing or future banking relationships.

- Financial and Reputation Damage: A missed vulnerability that leads to fraud or a breach will cost exponentially more than a proper pentest.

📌 DFW Example: A Fort Worth transmitter discovered — too late — that their budget pentest failed to catch a teller login flaw. Attackers exploited it, regulators investigated, and the firm’s compliance officer had to answer hard questions in Austin.

Quality Over Quantity in Pentesting

A meaningful penetration test is not about running as many scans as possible — it’s about thoroughness, context, and business alignment.

- Experienced Testers: Skilled professionals who know MSB-specific risks, not just generic vulnerabilities.

- Full Coverage: External, internal, and application-level testing mapped to compliance frameworks.

- Audit-Ready Reports: Findings documented in regulator- and bank-friendly language, not just raw scanner output.

What This Means for DFW Money Transfer Firms

Don’t fall into the trap of “cheap security.” For firms processing $5M–$50M annually, the real cost of a weak pentest isn’t the invoice — it’s the fines, lost partners, and reputational damage that follow.

Instead:

- Invest in compliance-aligned pentests (PCI DSS, Texas MSB, FinCEN).

- Work with a partner who understands DFW’s financial ecosystem.

- Use testing not just to find flaws — but to protect banking relationships and licensing stability.

Closing: Local Expertise Over Cheap Shortcuts

At CyberCile, we help Dallas–Fort Worth money transfer firms:

- Avoid false security from bargain pentests

- Align security testing with PCI, MSB, and FinCEN compliance

- Deliver audit-ready reports your bank partners will respect

👉 If you operate in Dallas, Plano, or Fort Worth and want quality pentesting built for MSBs, let’s talk.

📞 Request a Compliance-Ready Pentest Quote https://calendly.com/cybercile/15min