Why This Decision Matters in DFW

For money transmitters in Dallas–Fort Worth, compliance and trust are everything. A weak security posture can mean:

- Texas MSB license issues

- FinCEN penalties

- PCI DSS audit failures

- Or worst of all — loss of banking partners

We often hear the same question: “Do I need automated testing, or should I invest in a full manual pentest?” The answer depends on your goals — routine compliance vs. proving resilience against real-world fraud.

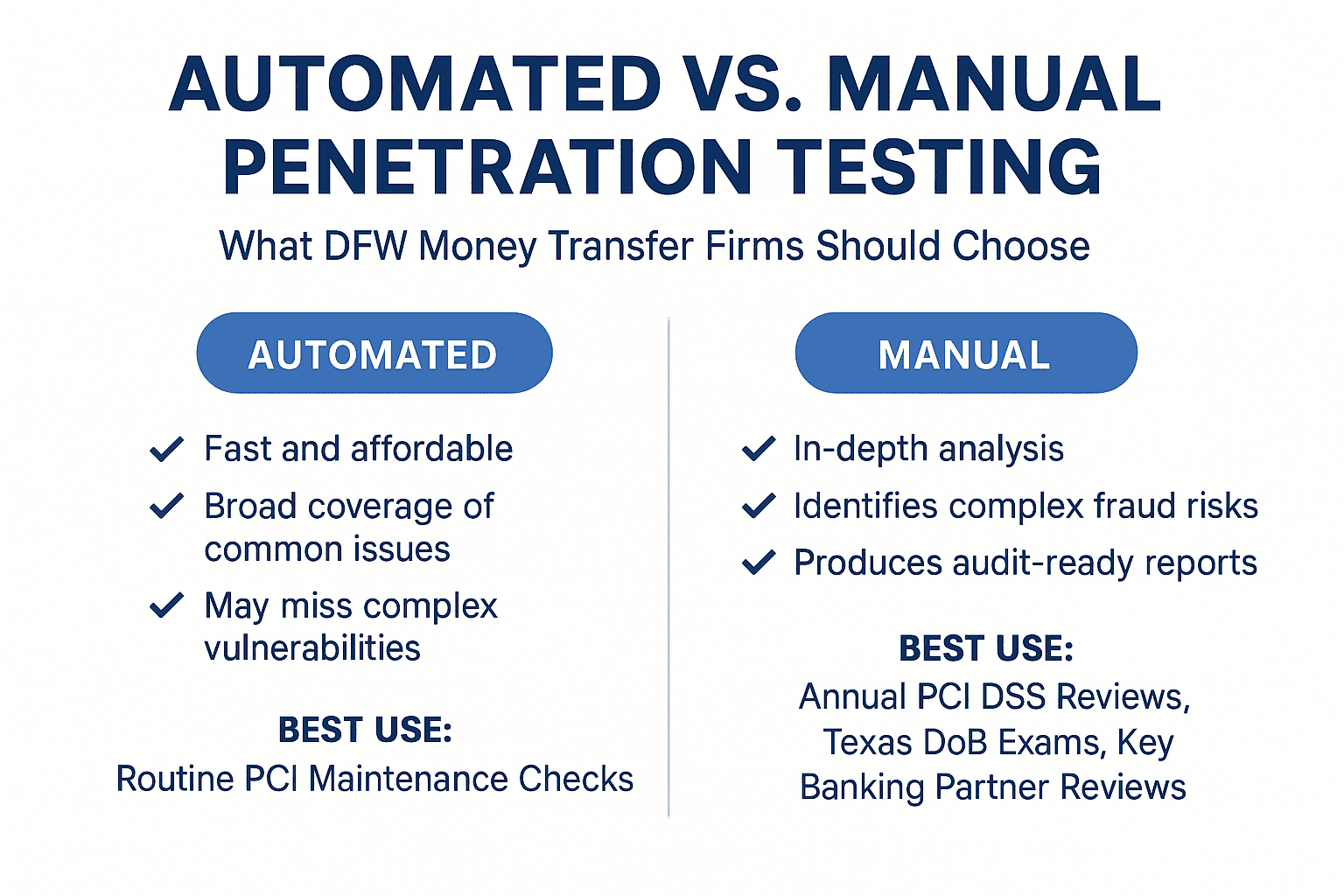

Automated Penetration Testing: Fast but Surface-Level

Automated pentesting uses tools to quickly scan for common issues: open ports, outdated software, weak configurations.

- Pros: Fast, affordable, broad coverage.

- Cons: Shallow. Misses complex vulnerabilities, produces false positives, limited business context.

📌 DFW Example: A Plano-based MSB ran automated scans and found “medium-severity” flaws. But in reality, those flaws could be chained into a critical risk. Automation alone didn’t show the bigger picture.

Best Use: Routine PCI maintenance checks, especially after system updates.

Manual Penetration Testing: Real-World Attack Simulation

Manual pentesting is where human testers think like attackers — chaining flaws, exploiting business logic, and testing your defenses under realistic conditions.

- Pros: Deep analysis, identifies complex fraud pathways, produces audit-ready reports.

- Cons: More time-intensive and higher upfront cost.

📌 DFW Example: A Fort Worth money transfer firm discovered through manual testing that weak teller logins + phishing could expose their entire transaction database. Fixing this saved their banking partnership.

Best Use: Annual PCI DSS reviews, Texas DoB examinations, or before onboarding with new banking partners.

Key Differences for DFW Firms

- Speed vs. Depth: Automated is fast but surface-level. Manual digs deep into fraud and compliance risks.

- False Positives vs. Actionable Reports: Automated tools flood you with noise. Manual pentests translate findings into bank- and regulator-friendly language.

- Cost vs. Risk: Automation is cheaper up front. Manual protects you from much costlier audit failures or fraud losses.

Hybrid Approach for Money Transfer Firms

The smartest DFW firms use both:

- Automated scans for ongoing PCI maintenance

- Manual pentests for audit cycles and banking partner reviews

This balance keeps costs manageable while ensuring compliance and real-world resilience.

Closing: Your DFW Pentesting Partner

At CyberCile, we help Dallas–Fort Worth money transfer firms:

- Run routine vulnerability scans for PCI upkeep

- Conduct manual pentests that satisfy Texas DoB examiners and partner banks

- Deliver reports in plain language for compliance officers and executives

👉 If you operate branches across Dallas, Plano, or Fort Worth, and want a security partner who speaks MSB compliance, let’s connect.

Schedule Your Automated + Manual Pentest Strategy Session https://calendly.com/cybercile/15min